Is Wealth Tax a trend in Latin America?

Brazil, Argentina, Chile, Colombia, Mexico, Peru, and Venezuela proposing or implementing a Wealth Tax?

Can Global Families Safely Navigate a Wealth Strategic Plan?

Spain’s Additional Wealth Tax on Taxpayers With $2.9 Million in Assets.

Spain’s new “Solidarity Tax” on wealth, announced at the end of September 2022, has now been introduced to parliament.

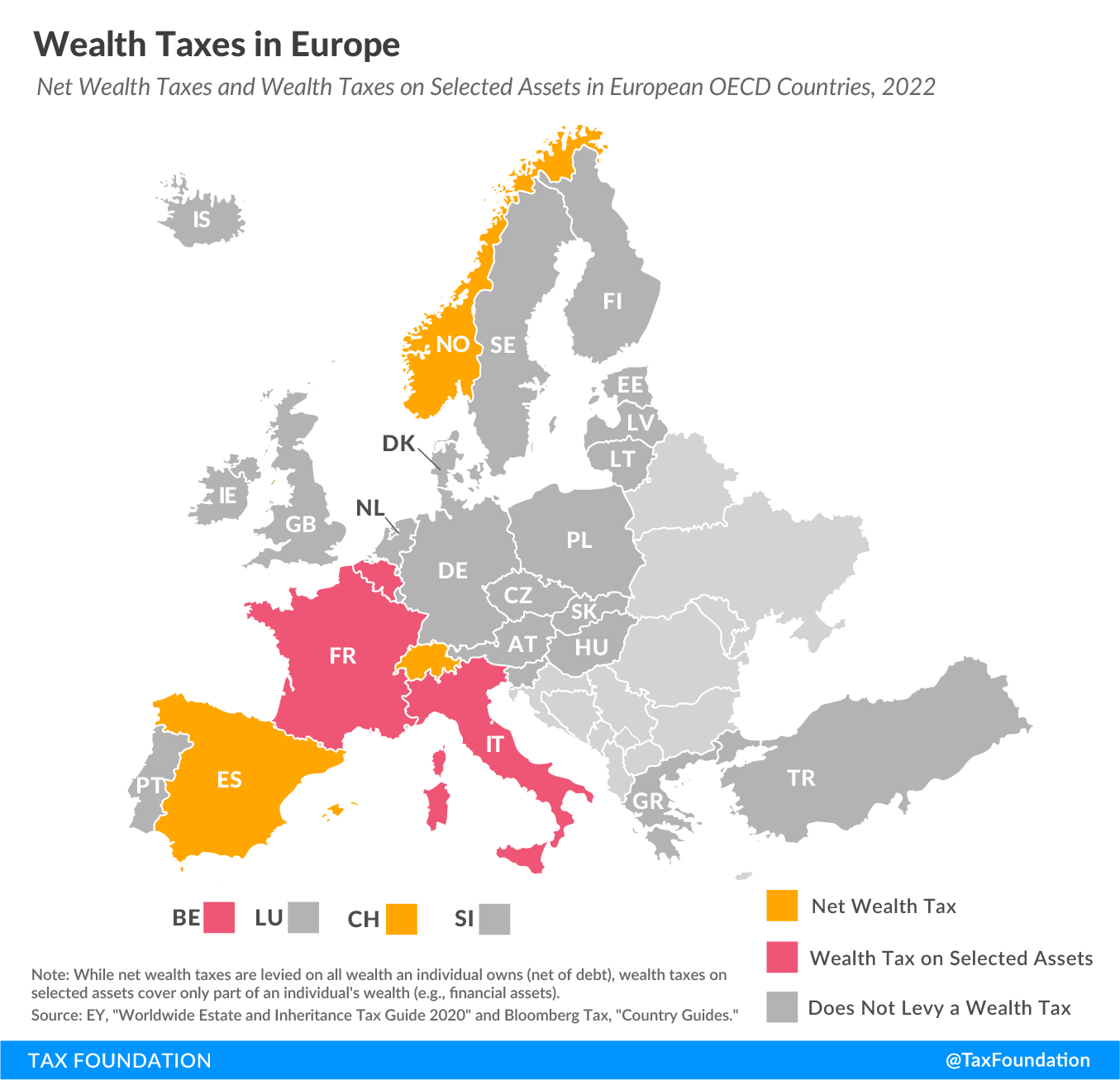

The country already has a wealth tax, but in some places, including Madrid, its effect has been heavily diluted in some regions because the autonomous regional governments have powers to vary the rates, allowances and reductions.

However, the new solidarity tax will be a national tax under the authority of the central government.

The tax is being advertised as a temporary measure that will apply only for two tax years, to be assessed annually on 31 December on individuals’ holding assets above EUR3 million. However, the temporary nature of the tax is not guaranteed. The legislation as it stands includes a clause allowing the situation to be evaluated at the end of the two-year period and either maintained or abolished.

For the purposes of the solidarity tax, each individual resident in Spain will have allowance of EUR700,000, plus EUR300,000 against the value of their main home.

The rates will be calculated in brackets:

· 1.7% on assets from EUR3 million to EUR5.35 million

· 2.1% on the next EUR5.3 million

· 3.5% on assets above EUR10.7 million.

Some countries in Latin America already implemented or have provisions that allow the government to impose wealth taxes.

In Brazil, for example, Article 153 of Brazilian Federal Constitution of 1988 allows the federal government to impose tax over large fortunes (i.e., a Wealth Tax), under the terms of a complementary law. However, up to now no such law has been enacted.

In general, the Brazilian recent tax proposals indicate that the Wealth Tax should apply over the worldwide assets of individual tax residents in Brazil and to assets located in Brazil owned by non-resident. The tax rates vary from 0.5% to 5%, depending on the total value of the wealth.

Since Brazilian tax residents must report all of their worldwide assets to the Brazilian IRS, such information should be considered to assess the value of the wealth and whether it should be subject to the Wealth Tax in Brazil.

Some proposals support the implementation of the Wealth Tax for a two-year period, similar to the Spanish model.

Source: Spanish parliament (text of the amendment)